Companies Report Changes in Accounting Estimates Retrospectively.

Companies report changes in accounting estimates retrospectively. COMPANIES SHOULD APPLY A CHANGE in accounting principle in an interim period retrospectively.

Changes in accounting principle-retrospective accounting change approach-when a company changes an accounting principle it should report the change using retrosepective application.

. Financial statement information about prior periods is on the same basis as the new accounting principle. Accounting errors result in accounting changes too. ОО Companies report changes in accounting estimated retrospectively.

These changes in estimates are to be recorded prospectively. The nature of change in accounting policy it will. Companies report changes in accounting estimates retrospectively.

C It is a change of accounting estimate and must be applied retrospectively. To start off changes in accounting. A change in accounting principle for which the.

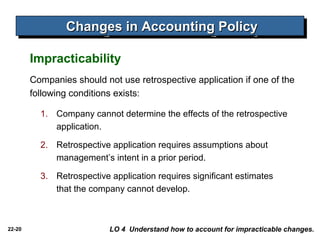

An indirect effect of an accounting change is any change to current or future cash flows of a company that result from making a change in accounting principle that is applied retrospectively. When it is impossible to determine whether a change in principle or change in estimate has occurred the change is considered a change in estimate. When it is impossible to determine whether a change in principle or change in estimate has occurred the change is considered a change in estimate.

ANSWER The statement is FALSE Reason IAS 8 Accounting Policies Changes in Accounting Estimates and Errors is applied in selecting and app View the full answer Transcribed image text. Recording and Reporting a Change in Accounting Principles. Changes in accounting estimates and principles.

List the name of standard and interpretation which causes the change to policy. When there is change in accounting policy company require to disclose the following. Accounting changes that result in financial statements of a different reporting entity are reported prospectively by restating all prior periods.

Let the investors know that you made a change b. Changes in the reporting entity continue to be applied retrospectively. Companies account for a change in depreciation methods as a change in accounting principle.

A company recently moved to a new building. Companies report changes in accounting estimates retrospectively. Allowance for doubtful accounts.

A change in accounting estimate is accounted for prospectively. Errors correction depends on the period they are recovered in and if comparative statements are issued. Companies refine accounting estimates as a result of changing circumstances each time financial statements are prepared.

Most changes in accounting estimates are accounted for retrospectively. Companies account for a change in depreciation methods as a change in accounting principle. A change in accounting estimate for which the financial statements for prior periods included for comparative purposes should be presented as previously reported.

The method of applying the change and. The old building is being actively marketed for sale and the company expects to complete the sale in four months. Recording and Reporting Change in Accounting Principle Whenever a change in principle is made by a company the company must retrospectively apply the change to all prior reporting periods as if the new principle had always been in.

Companies report changes in accounting estimates retrospectively. False When it is impossible to determine whether a change in principle or change in estimate has occurred the change is considered a change in estimate. A change in the reporting entity is considered a special type of change in accounting principle that produces financial statements that are effectively those of a different reporting entity.

In the example above if X company in 20X2 changes the inventory valuation method from FIFO to average so that new accounting policies should be applied retrospectively. A change in estimate arises from the appearance of new information that alters the existing situation. A company has decided to change its depreciation method to better reflect the pattern of use of its equipment.

Nature of the change in accounting principle. An example of a change in an accounting estimate affecting both the current reporting period and the future periods of the change in the estimate is a change in the estimate of the useful life of a fixed asset where the effect is applied prospectively by allocating the carrying amount of the fixed asset over the current and future periods during the remaining. The standard requires compliance with any specific IFRS applying to a transaction event or condition and provides guidance on developing accounting policies for other items that result in relevant and reliable.

Change from GAAP to another GAAP. A change in reporting depreciation charges as cost of sales rather than as. IAS 8 is applied in selecting and applying accounting policies accounting for changes in estimates and reflecting corrections of prior period errors.

Changes in accounting principle and changes in reporting should be accounted for retrospectively whereas changes in accounting estimates should be accounted for prospectively. The change in accounting policy will be applied prospectively which is the same to change in accounting estimate. When it is impossible to determine whether a change in principle or change in estimate has occurred the change is considered a change in estimate.

A description of the prior period information that has been retrospectively adjusted if any. A change in inventory valuation from average cost to FIFO. Conversely there can be no change in estimate in the absence of new information.

Examples of common changes in accounting estimates include revision of an estimate of the useful life of equipment and changes in the expected damages from lawsuits. It adjust its financial statements for each prior period presented. Examples of Changes in Accounting Estimate.

Whenever a change in principles is made by a company the company must retrospectively apply the change to all prior reporting periods. Companies report changes in accounting estimates retrospectively. All of the following are situations where there is likely to be a change in accounting estimate.

Intermediate Accounting Ppt Download

Impact Of Change In Accounting Standards To Frs 102

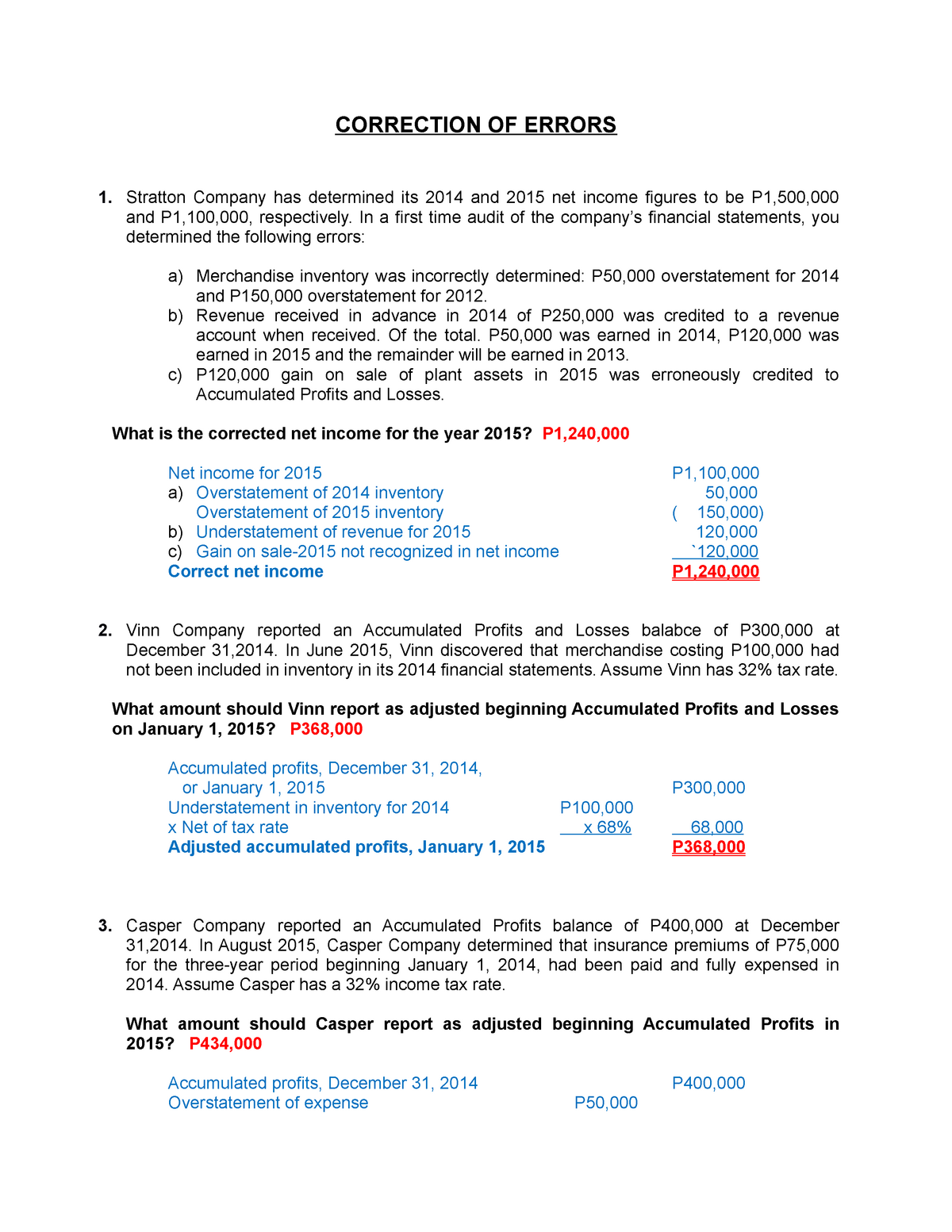

Correction Of Errors Docx Business Taxation Tax1102 Feu Studocu

Intermediate Accounting Ppt Download

Intermediate Accounting Ppt Download

Change In Accounting Principle Youtube

Accounting Changes And Error Analysis Ppt Download

Accounting Changes And Error Analysis Learning Objectives Accounting

Chapter 10 Change In Accounting Estimate Pdf Depreciation Accounting

Accounting Changes And Error Analysis Ppt Download

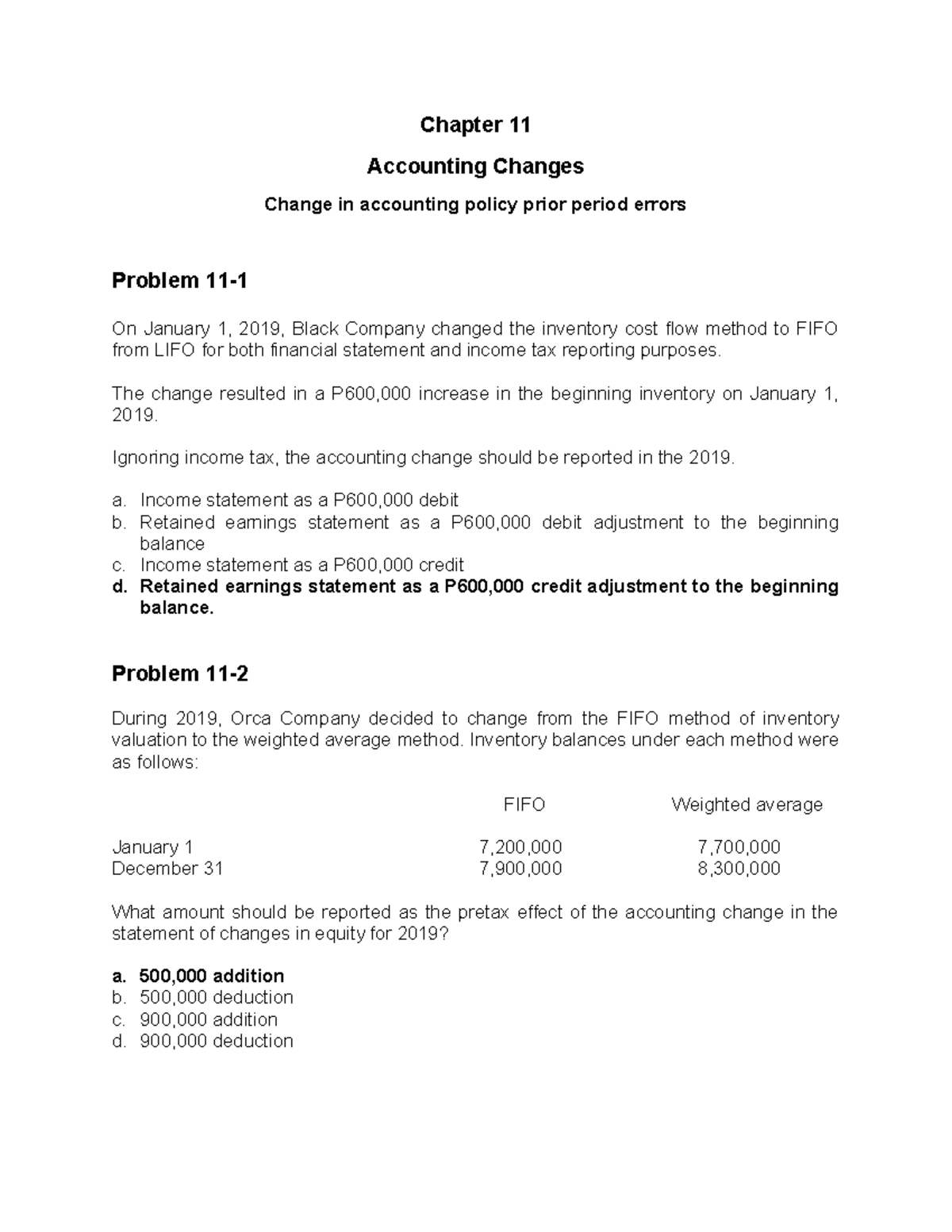

Change In Policy Problems Chapter 11 Accounting Changes Change In Accounting Policy Prior Period Studocu

Pdf Reporting Practice Of Accounting Disclosure On Changes In Listed Companies Of Bangladesh

Cfas Pfa And Tfa Pdf Retained Earnings Debits And Credits

Moving To New Ifrs17 Standards Finance Sap Consulting Companies

Separate And Consolidated Financial Statements Stock Acquisition Questions Docx

Comments

Post a Comment